How Do You Get Financial Aid for Online Education?

It is commonly misperceived that online education is always cheaper than a campus based college or university. This is not always true, and the price of education is affected by many variables, including location, subject matter, length of program, and institutional policy. No matter what the sticker-price of your degree is, though, there are financial aid options that can soften the financial blow and let you pursue higher education without astronomical debt. The most common forms of student financial aid are:

- Loans, both governmental and private

- Scholarships

- Federal Grants

- Employer education stipends

- G.I. Bill benefits

A combination of these financial aid options can mitigate the expense of education, and help make it a worthwhile investment in your future earning potential.

Government Loans and Grants

Many college students take out loans, and the U.S. government offers an array of student loans with fair interest rates and flexible repayment plans. The government also offers grants, which are more difficult to get, but do not need to be paid back. To be eligible for government student loans you must:

- Be a U.S. citizen or eligible noncitizen.

- Have a valid social security number.

- Register, or already be registered, with selective service for the armed forces.

- Have a high school diploma, GED, or other proof of qualification or prior education for college admittance

- Maintain a good academic record in your program.

How to Apply

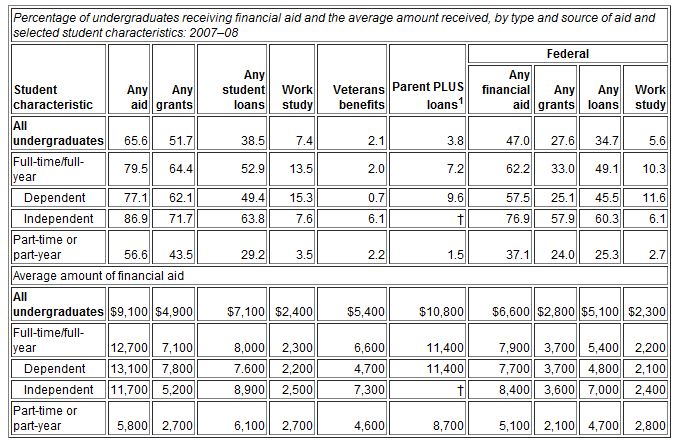

The Free Application for Federal Student Aid (FAFSA) is the primary way to apply for Perkins and Stafford loans, the two most common governmental student loans. The government determines your level of financial need and thereby the amount of federal money you can borrow based on your FAFSA application. The graph below shows the percentage of students who got federal financial aid, and the amounts of different aid-types they got. The statistics shown are from the U.S. Department of Education’s National Center for Education Statistics.

The Stafford Loan

The Stafford loan comes in both subsidized and unsubsidized versions. Subsidized Stafford loans are only available to students with demonstrated financial need. This loan does not accrue interest while the student is enrolled, or during a six month grace period after completion of studies.

Unsubsidized Stafford loans are available to anyone, but will start accruing interest at a fixed rate of 6.8 percent as soon as the loan is paid out. If you allow this interest to accumulate, it will eventually be “capitalized,” which means it is added to the total amount of your loan, and is also subject to interest charges. It is a good idea to pay off interest as it accrues, thereby minimizing your total costs, rather than allowing the interest to capitalize, which eventually leads to you being charged interest on interest. Both subsidized and unsubsidized loans can be repaid on flexible schedules depending on your income and other factors after you have finished school.

The Perkins Loan

Perkins loans are available only to students with major financial need at both undergraduate and graduate levels. Perkins loan repayment is deferred for as long as you attend school more than half time, and there is a nine month grace period after you graduate or drop below half time in school. The loan accrues interest at a rate of five percent.

Grants

Grants are the most desirable form of financial aid for students because they never need to be repaid! Federal Pell Grants are available to undergraduate students without a bachelor’s or professional degree, or postbaccalaureate students in teaching certification programs. The current highest Pell grant award is $5,550. Special consideration is given to Pell grant applicants who had a parent die in Iraq or Afghanistan after September 11, 2001.

The Teacher Education Assistance for College and Higher Education (TEACH) grant is for students taking classes to become elementary or secondary teachers. This grant is limited to students of participating schools.

Many colleges offer institutional grants as well, which use private funds instead of government money to aid students, often based on merit or demonstrated commitment to a particular field of study.

Work Study

Work Study opportunities are a widely available form of governmental student aid. A student with a work-study benefit can get a governmentally sponsored job on or off campus to earn money to offset their college expenses. Most work-study opportunities are on campuses, but off campus jobs, especially at non-profit organizations working in the public interest, can also offer work study benefits.

Work Study opportunities are a widely available form of governmental student aid. A student with a work-study benefit can get a governmentally sponsored job on or off campus to earn money to offset their college expenses. Most work-study opportunities are on campuses, but off campus jobs, especially at non-profit organizations working in the public interest, can also offer work study benefits.

The G.I. Bill

The G.I. Bill is a law that provides special financing and scholarships for members of the armed forces, both active duty and retired, and their families. The law’s most recent iteration, dubbed the “Post 9/11 G.I. Bill,” has been in effect since August, 2009, and includes several updates to provide for veterans of the wars in Iraq or Afghanistan and their families. Benefits are also available for the children of servicemembers who died after September 11, 2001.

The amount of money available to you through the G.I. Bill may depend on the length and nature of your service in the armed forces. The official Veteran’s Affairs website (http://gibill.va.gov/) has electronic applications, benefit calculators, and other tools for veterans who want to cash in their benefits and pursue higher education.

Scholarships

Most scholarships are paid with private funds, and often reflect the interests of the organization that offers them. Universities offer scholarships for students in certain fields of study, students from certain backgrounds, and students who performed particularly well in high school, as well as to other demographics. Scholarships do not need to be paid back, and are often renewable on an annual basis for students who continue to meet or exceed the criteria for the scholarship.

There is no central clearinghouse for all scholarships, so talking to a student advisor and doing research on your specific institution’s web site are the best ways to find out about these opportunities. The government offers research tips and a free scholarship finding tool on its official student aid website.

Tax Credits

Tax Credits

Tax credits are a way for the government to help you pay for college without giving you cash up-front. There are two education tax credits offered by the Internal Revenue Service right now.

- The American Opportunity Credit, also sometimes called the HOPE credit, allows you to subtract up to $2,500 from the taxes you would have paid to the government, depending on your income and educational expenses for the year. Visit the IRS’s education tax credit web page to determine whether you are eligible for this credit, and for how much.

- The Lifetime Learning credit operates similarly to the American Opportunity Credit, but the amount of the credit is calculated differently. A student cannot take both credits in a single school year, so you should calculate which one will save you more money before choosing which to accept.

Another way to lower the taxes you pay while you’re in school is to start a Coverdell Education Savings Account, which allows you to deposit a certain amount of money, commensurate with your education costs, up to $2,000, which is then untaxable.

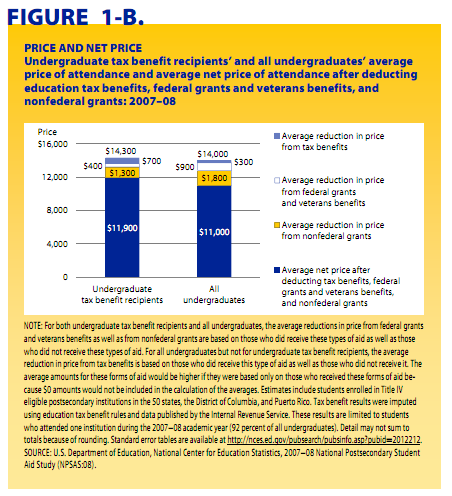

Each of these IRS benefits may not save you much money in a single year, but in combination with other forms of financial aid, and spread over several years of education, your education costs can be reduced by thousands of dollars if you do the work to claim these tax credits. The chart below shows the average savings from tax benefits and federal grants for undergraduate students for the 2007-08 school year.

What Not To Do

Financing your education with a steadily increasing mound of credit card debt is a dangerous game to play with your money and future. Credit cards have notoriously high interest rates and unforgiving repayment options. While taking on small amounts of credit card debt as a bridge between steady incomes can help you through a tough period, taking on credit card debt with no guarantee of a well-paying job in the future can seriously affect your credit score and your future ability to secure safer, more worthwhile loans.

Even if it means taking longer to finish your education, keeping a job while you take classes so that you can pay as you go is a safer financial situation than piling up debt. Statistics show that college graduates tend to earn more money than people without degrees, but there’s no guarantee you’ll get a great job immediately out of school, so playing it safe with your finances is the best option.

Go Out and Do It!

Financial aid is available for those who seek it. Do the research and the legwork it takes to secure various types of governmental and private financial aid, and you’ll save money in the long run while increasing your earning potential by getting a higher degree.

/how-do-you-get-financial-aid-for-online-education